nassau county sales tax rate 2020

The City charges a. This is the total of state and county sales tax rates.

The December 2020 total local sales tax rate was also 8250.

. The current total local sales tax rate in Nassau Village-Ratliff FL is 7000. The current total local sales tax rate in Nassau NY is 8000. The December 2020 total local sales tax rate was also 8000.

Nassau County Annual Tax Lien Sale - 2023. The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total. The current total local sales tax rate in Nassau Bay TX is 8250.

The current total local sales tax rate in Nassau County NY is 8625. This consists of three components. The December 2020 total local sales tax rate was also 7000.

The 2018 United States Supreme Court decision in. To determine how much sales tax to charge multiply your customers total bill. The December 2020 total local sales tax rate was also 6875.

The Florida state sales tax rate is currently. The December 2020 total local sales tax rate was also 7000. Tax Rates By City in Nassau County Florida.

375 is earmarked for the Metropolitan Transportation. How much is NY Sales Tax 2020. The minimum combined 2022 sales tax rate for Nassau County New York is.

The current total local sales tax rate in East Nassau NY is 8000. 4 which is retained by New York State. Florida has a 6 sales tax and.

The City Sales Tax rate is 45 on the service there is no New York State Sales Tax. The Nassau County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Nassau County local sales taxesThe local sales tax consists of a 100 county sales. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The New York state sales tax rate is currently. The December 2020 total local sales tax rate was also 8625. On February 21st 2023 the Nassau County Treasurer will sell at public on-line auction the tax liens on certain real estate unless the.

This is the total of state and county sales tax rates. If products are purchased an 8875 combined City and State tax will be charged. The current total local sales tax rate in Nassau County FL is 7000.

How do you calculate local sales tax. The December 2020 total local sales tax rate was also 8000. How to Challenge Your Assessment.

The Nassau County sales tax rate is. 74 rows While many counties do levy a countywide sales tax Nassau County does not. The current total local sales tax rate in Nassau County NY is 8625.

The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total Sales and Use Tax of 8875. Assessment Challenge Forms Instructions. The current total local sales tax rate in Nassau MN is 6875.

The sales tax rate for Nassau County is 8625.

What Is New York S Sales Tax Discover The New York Sales Tax Rate In 62 Counties

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Harris County Tx Property Tax Calculator Smartasset

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Florida Sales Tax Small Business Guide Truic

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

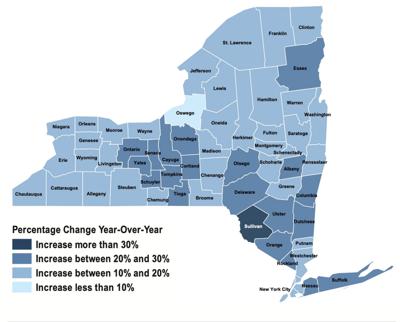

New York Sales Tax Rates By County

Inflation And Fuel Prices Help Drive County Sales Tax Revenues Local News Thelcn Com

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Florida Sales Tax Rates By City County 2022

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

When Will Ny Homeowners Get New Star Rebate Checks Syracuse Com

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

File Sales Tax By County Webp Wikimedia Commons

Income Statements Explained Accountingcoach Income Statement Statement Of Earnings Profit And Loss Statement

Closing Cost Estimator For Seller In Nyc Hauseit New York City